Try This Clever Way To Stay Motivated And On Track, Episode 213

No time to listen now? We'll send it to your inbox.

No time to listen now? We'll send it to your inbox.

or scroll down to get the highlights

Stay Motivated And On-Track with This Mindset Trick

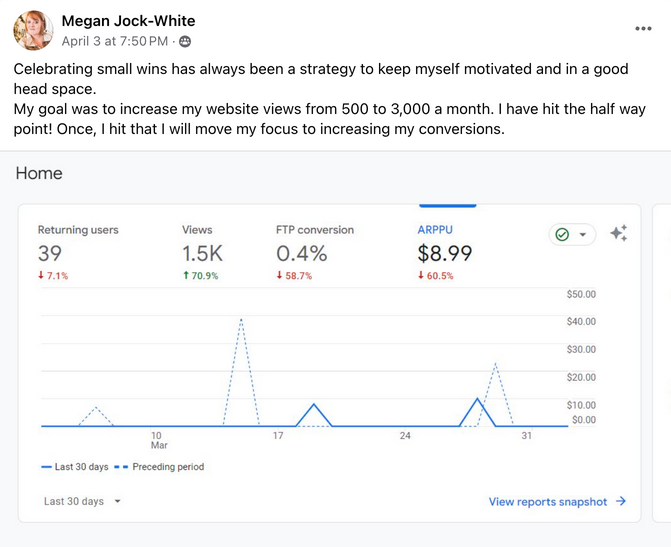

Meet Megan Jock-White, a new-ish Inner Circle member and all-around powerhouse of an entrepreneur whose journey through personal challenges led to the creation of Windsor Lane, a thriving handmade sign company.

We talked recently about how Megan transformed her battle with anxiety into a flourishing business by celebrating small victories—a strategy that has been game-changing for her mental health AND for her business success.

From Anxiety to Entrepreneurship

Megan never actually intended to start a business. In fact her venture into the world of e-commerce began unexpectedly in 2016 when she was seeking ways to manage a crippling anxiety disorder. Despite “not having a creative bone in [her] body”, Megan turned to art therapy, a suggestion from her therapist that would kick-start her business journey. Megan’s initial projects, created from pallet wood her husband salvaged and basic art supplies, were intended to bring some peace into her life. But after sharing her creations on Facebook, the overwhelming response from her friends and family opened the door to a new business opportunity, and Windsor Lane was born.

“I was flabbergasted because I started getting a whole bunch of people from my local community sending me messages and asking me if I would make them a sign. And it just never stopped.”

Once they realized they had a viable sign business that might allow Megan to continue her recovery while staying home with their children, she and her husband Aaron decided to take a chance. They set up a Facebook page and created a group where they could host exclusive sales and dropped 20 to 30 new signs each Friday night. Group members who commented first on a post received a 50% discount, while others could still purchase it for 20% off.

The group quickly gained traction, bringing in up to 100 participants each Friday night. The competitive nature of the sales (hello exclusivity, urgency and scarcity!) Episode 212 here and was fun for everyone and the group became the talk of Megan’s town.

Soon they expanded to Etsy and made their first sale just a week after joining.

From Etsy To E-Commerce Empire

From its humble beginnings, Windsor Lane expanded to various platforms including Faire, Amazon FBA, Amazon Handmade, TikTok, and eventually their own e-commerce site windsorlanedecor.com whose website traffic has recently tripled.

Surprisingly, it’s Megan’s experience managing her anxiety disorder to which she attributes the success. During her recovery, Megan often found herself so overwhelmed by future uncertainties that she developed monophobia, a fear of being alone. It was so severe that her husband Aaron quit his job to provide support.

But Megan refused to let anxiety dominate her life. She devised a personal recovery plan she refers to as “practice,” starting with small goals like spending five minutes alone and gradually increasing this time. Celebrating these small victories was crucial; it reinforced her progress and helped her regain independence. Now, eight years later, she has fully recovered and cherishes her alone time—a complete transformation.

Megan’s method of staying motivated while maintaining a positive headspace has been key to her success in business, as well. Like most e-commerce store owners, Megan’s initial progress was slow. But applying the same principles of small, incremental victories from her personal recovery to her business strategy kept her from getting discouraged. Simple daily achievements, like completing tasks, are celebrated, reinforcing a positive mindset and continuous progress.

“If you’re a parent like me, when [your babies are] learning to roll over or crawl or walk, when they roll over just a little bit, you’re not like, oh, well, they didn’t do it…You’re on the phone with grandma and you’re on the phone with your best friend, you’re posting it on Facebook and you’re celebrating that!

So you kind of have to take care of your inner child. You know, like, hey, you know what, you did it. You may not have gotten there overnight, but you’re making improvements little by little.

And that’s how I like to think about it.”

Megan’s Success Path: Track, Measure, Celebrate

Megan employs her “practice” to her business via a disciplined and systematic approach to her daily operations. This method boosts her bottom line, and creates a positive work culture that keeps her and her team motivated and focused on continued progress. Here’s how she applies the practice to her business:

Setting Consistent Daily Goals: Megan emphasizes the importance of consistency in her daily routine. By committing to specific tasks each day, she ensures steady progress towards her business goals.

Breaking Goals into Manageable Steps: Megan divides larger goals into small, achievable steps. This allows her and her team to experience frequent victories, maintaining motivation and focus.

Tracking and Measuring Progress: By keeping close tabs on her achievements, Megan can see the direct results of her efforts. This tracking helps her understand what strategies work best and how close she is to meeting her goals.

Creating a Culture of Celebration: Within her business, celebrating small wins is part of the company culture. Megan teaches her employees to appreciate their own efforts and the collective progress of the team, reinforcing a positive workplace environment.

Maintaining Non-Negotiable Daily Tasks: Megan has identified three critical tasks that need to be completed every day to ensure the business continues to thrive. These include posting a new listing on Etsy, updating a TikTok listing, and pinning on Pinterest. Consistently performing these tasks keeps her platforms active and engaging for customers.

Incorporating Celebrations into Daily Activities: Megan and her team take a moment to celebrate each sale they make. Whether it’s a simple cheer or a momentary pause to acknowledge the success, these celebrations boost morale and reinforce the significance of every accomplishment.

Megan’s Secret Weapon: Consistency

It’s important to emphasize just how often Megan mentions the role of consistency in her success. Staying consistent has repeatedly proven to be a key predictor of success for her, both personally and professionally.

“The best way to start is to focus on things that are in your control. So that could be as simple as writing out your to-do list for the day…and then when you get to the last thing, celebrate that.

And you’re not going to really be focusing on the bad stuff anymore. You’re going to look at everything in a positive light. The more consistent you are with that every day, you’re going to start seeing more things like wins.”

You can check out Megan and Aaron’s work at www.windsorlanedecor.com

RELATED LINKS:

Do You Have These 7 Habits That Predict Success?

https://thesocialsalesgirls.com/do-you-have-these-7-habits-that-predict-success-episode-205/

How This Tiny Shop Quadrupled Sales By Changing One Thing

How Long Will It Take To Reach Your Goals?

https://thesocialsalesgirls.com/how-long-will-it-take-to-reach-your-goals-episode-203/

Our Favorite Strategies For Success In 2024

https://thesocialsalesgirls.com/heres-what-to-do-differently-next-year-episode-195/